Secure the well-being of your family through Triple Protection..

In the unfortunate event of a parent's death, Kotak Life Insurance helps lessen the financial burden the child might face by providing the benefit of triple protection as follows:

![]() Your beneficiary is paid the Life cover amount immediately to compensate for immediate loss of income.

Your beneficiary is paid the Life cover amount immediately to compensate for immediate loss of income.

![]() All Future premiums of this insurance policy will be waived and fully paid for by Kotak Life Insurance.

All Future premiums of this insurance policy will be waived and fully paid for by Kotak Life Insurance.

![]() Your beneficiary will receive the Fund value of the policy at maturity.

Your beneficiary will receive the Fund value of the policy at maturity.

Flexible premium payment period:

To ensure that a long term payment obligation does not hamper you from planning your finances, we offer you the following payment methods:

5 year premium payment period for a policy term of 10 years, Or

10 year premium payment period for policy terms of 15 to 25 years.

In addition, with the option to pay annually, half-yearly, quarterly or monthly, this could be an apt child plan for your children and you.

Receive a planned corpus at maturity

Your regular investments made with this plan will provide you with a planned corpus upon the maturity of the plan, ensuring that the cost of education will never be a deterrent to fulfilling your children's dreams.

Build the maturity amount as per your risk return preference:

Our range of SEVEN (7) Funds is suitable for all types of investors, aggressive or safe.

Invest in the fund option most suited for your risk-returns preference to build a corpus in a way you deem fit.

Whichever the fund you choose, you can be rest assured that it is managed by our team of highly qualified fund managers.

Whether you manage your portfolio actively or leave things to our investment experts, you'll find a suitable fund from our range of funds catering to different risk profiles.

One fine body...

In case the life insured commits suicide within one year of date of issue of the policy, the beneficiary will still receive the fund value.

Benefits earned under this plan are in accordance with the Income Tax Act, 1961. You can avail tax benefits on:

Your premiums under Section 80C.

Maturity or death claim proceeds under Section 10 (10D).

Tax benefits under the policy will be as per the prevailing income tax laws and are subject to change in the tax laws. You are advised to consult your tax adviser for details.

| Entry Age | 18 to 60 years |

|---|---|

| Policy Term | 10, 15 to 25 years |

| Basic Sum Assured | Entry age of below 45: Min: Higher of 10 x annualised premium OR 0.5 x policy term x annualised premium Entry age of 45 and above Min: Higher of 7 x annualised premium OR 0.25 x policy term x annualised premium Maximum: 25 x annualised premium. |

| Premium Payment Mode | Annual and half-yearly |

| Premium Levels | Minimum: Regular and 10 PPT Yearly - 20,000 p.a. and Half-yearly - 10,000 5 PPT Yearly - 50,000 p.a. and Half-yearly - 25,000 Maximum: No limit |

| Premium Payment terms |

Regular plan: 10 /15 to 25 years (equal to the policy term) Limited premium paying plan: 5 years with policy term 10 years 10 years with policy terms 15 to 25 years |

Insurance is the subject matter of the solicitation.

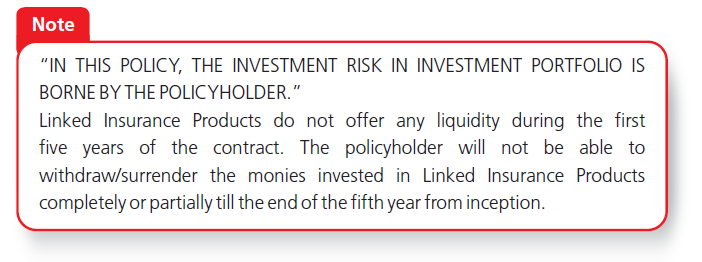

This is a Unit-Linked non-participating plan

This website content is not a brochure and only gives the salient features of the plan. For more details on risk factors, terms and conditions please read the sales brochure carefully before concluding a sale. For more details on rider benefits, please refer to the rider brochure.