With Protection Plans you can give your family ;

To enjoy an insurance cover wherein you are not under-insured, you need to know your Human Life Value.

(Call your Professional Financial Practitioner, to Know your HLV!)

Simply put, Human Life Value would provide an estimated figure of the financial amount your family would require to meet their expenses and liabilities, in case something unfortunate was to happen to you.

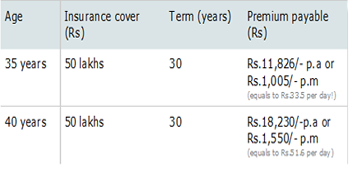

Though the premium payable on term plans is considerably lower vis-a-vis other life insurance, the premium differs with age.

As the age increases, so does the cost of policy.

The cover gets more expensive as you age. Use your age to your advantage by opting for it today! Lock yourself into a lower premium amount throughout the policy period.

Through Term Plans "The BEST GIFT" that you and your family receive is the freedom from financial worries. A Term Plan - Kotak Term Plan / Kotak Preferred Term Plan, enables you to give your family:

Your untimely death may deprive your dependants of emotional security. But, you're timely and wise decision of choosing a Term plan - Kotak Term Plan / Kotak Preferred Term Plan will surely not rob them of financial stability, even when you are no longer around.

You wouldn't want to burden your family with the responsibility of repaying your loans, should anything unfortunate happen to you. Don't let misfortune snatch away your family's happiness. In case of your untimely death, the benefits under your loan protection plan would be sufficient enough for repaying your loans, including your home loan. With a home loan protection plan, you can ensure that your family continues to own the house that you so fondly purchased for them.

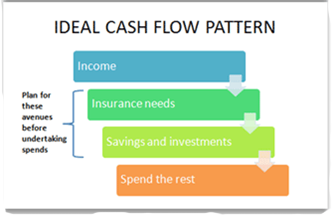

Protecting your future against misfortune should be the first step in financial planning.

Once you have secured the future well, you can then look at creating an investment portfolio that will let you achieve your financial goals.

In other words, you should first take care of your protection needs before you set aside funds for savings, investments or expenditure.

You wouldn't want anything to come in between your dear ones and their dreams. With term plans in place, you can be assured that they continue to enjoy financial independence and live their dreams, even if you are not around to support them.

Riders enhance your insurance cover and are optional benefits that you may add to your Term Plan Kotak Term Plan / Kotak Preferred Term plan policy.

You can avail of the following riders -

Kotak Critical Illness Benefit : This rider lets you enjoy greater financial stability against chronic diseases such as heart attacks, cancer, stroke, Coronary Artery By- pass Graft (CABG) surgery, kidney failure, major organ transplants, paralysis, loss of limbs, aorta surgery, major burns, heart valve surgery and blindness.

Kotak Accidental Death Benefit:

Opting for this rider can render enhanced financial security to your loved ones. In the event of your unfortunate demise arising due to an accident during the term of the insurance policy, an additional amount (Kotak Accidental Death Benefit Sum Assured) is payable.

Kotak Permanent Disability Benefit:

This benefit provides basic sum assured to the life insured person in case he/she becomes totally and permanently disabled due to an accident.

Investment in life insurance plans can let you enjoy tax benefits* under Section 80C and 10(10D) of Income Tax Act, 1961. As per section 80C premium paid up to Rs 1 lakh (provided the premium paid is less than or equal to 20 per cent of the sum assured on the policy) can be deducted from your taxable income. Under section 10(10D), the life insurance proceeds receivable does not attract any tax in the hands of the recipients.* subject to change, consult your tax advisor, before finalizing the plan.

Enjoy "Faidey Ka Insurance"! With our kotak Term Plans / Kotak preferred Term Plans, gain large Sum assured for low premium payouts! A monthly premium of only Rs.394, can give a 30yr old, male, Non-tobacco user, an insurance cover of Rs.25 Lakhs, for a term of 15 yrs.

In the event of the life insured committing suicide within one year of the date of issue of the policy, 80% of the premiums paid shall be payable to the nominee.

In case of suicide within one year of the date of revival, when the revival is done within 6 months from date of first unpaid premium: Suicide Exclusion shall not be applicable and the Death Benefit under the product shall be payable.

However, in case of suicide within 1 year of the date of revival, when the revival is done after 6 months from the date of first unpaid premium : Higher of 80% of Premiums Paid or Surrender Value (if any) at the date of claim shall be payable.

Tax benefits & Disclaimer

Benefits earned under this plan are in accordance with the Income Tax Act, 1961. You can avail tax benefits on:

1.Your premiums under Section 80C.

2. Maturity or death claim proceeds under Section 10 (10D)

Tax benefits under the policy will be as per the prevailing income tax laws and are subject to change in the tax laws. You are advised to consult your tax adviser for details.