Guaranteed Additions*

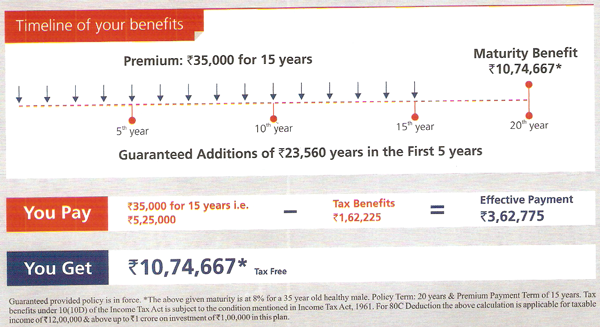

In the first 5 policy years, Guaranteed Additions at 5% p.a. (simple) of Basic Sum Assured will accrue, payable either on maturity or on death whichever is earlier.

*Subject to the policy being in force

Earn bonus from 6th policy year onwards

Bonuses start accruing from 6th year onwards.

Convenience to select from multiple options of premium payment term.

Plan offers the flexibility of paying Regular premiums OR Limited Premium Payment for 5, 7, 10 or 15 yrs for various Term combinations.

One fine body...

Read Brochure

Read Brochure

You may avail of tax benefits under Section 80C, 80D and Section 10(10D) of Income Tax Act, 1961 subject to conditions as specified in those sections. Tax benefits are subject to change as per tax laws. You are advised to consult your Tax Advisor for details. Service Tax shall be levied over and above premium amount shown here as per applicable tax laws.

Insurance is the subject matter of solicitation.

This is a savings-cum-protection oriented Participating Endowment Plan. This website content only gives the salient features of the plan.

For more details on risk factors, terms and conditions please read the sales brochure carefully before concluding a sale.

Read Brochure

Read Brochure

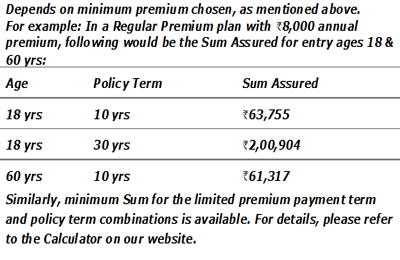

| Entry Age* | 18 - 60 yrs |

|---|---|

| Maximum Maturity Age | 70 years |

| Policy and Premium Payment Term (PPT) | Regular Pay: Same as policy term Limited Pay: 5 , 7 , 10 & 15 yrs |

| Policy Term : | Regular Pay: 10 - 30 years Limited Pay: 5 Pay: 10 to 30 yrs 7 Pay & 10 Pay: 15 to 30 yrs 15 Pay: 20 to 30 yrs |

| Minimum Premium | Regular Pay: Limited Pay: |

| Premium Payment mode: | Yearly, Half yearly, Quarterly, Monthly |

| Minimum Sum Assured on Maturity |

|

| Premium Payment | Premium mode Premium modal factor Annual 100% Half-yearly 51% Quarterly 26% Monthly 8.8% Premium payment = Premium mode x Premium modal factor |

Insurance is the subject matter of the solicitation.