![]() Guaranteed Income payable every year during the Payout Period

Guaranteed Income payable every year during the Payout Period

![]() Income Boosters increases the Guaranteed Income between 5% to 7% every year

Income Boosters increases the Guaranteed Income between 5% to 7% every year

![]() Higher the annual premium, higher will be the Guaranteed Income

Higher the annual premium, higher will be the Guaranteed Income

![]() Death benefit is payable irrespective of Guaranteed Income already paid

Death benefit is payable irrespective of Guaranteed Income already paid

![]() Guaranteed Maturity Benefit along with the last payout

Guaranteed Maturity Benefit along with the last payout

![]() Customise Protection through a wide range of Riders

Customise Protection through a wide range of Riders

![]() Tax benefit on premiums paid u/s 80(C) and benefit received u/s 10(10D) of Income Tax Act, 1961

Tax benefit on premiums paid u/s 80(C) and benefit received u/s 10(10D) of Income Tax Act, 1961

One fine body...

Read Brochure

Read Brochure

You may avail of tax benefits under Section 80C, and Section 10(10D) of Income Tax Act, 1961 subject to conditions as specified in those sections. Tax benefits are subject to change as per tax laws. You are advised to consult your Tax Advisor for details.

Insurance is the subject matter of solicitation.

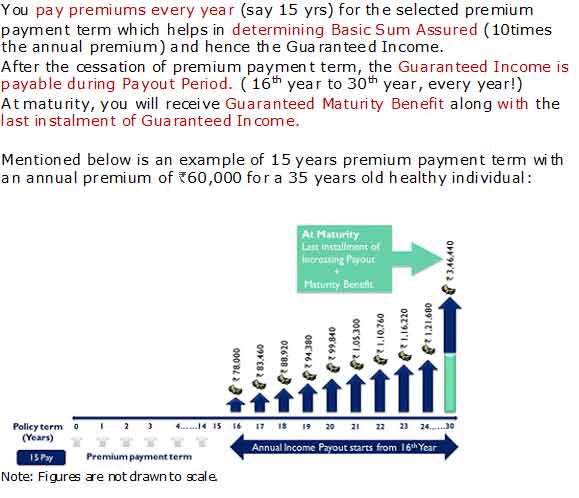

Guaranteed benefits due under this plan are available provided premiums are paid regularly for the entire premium payment term and the policy is in force.

This is a non-participating guaranteed income anticipated endowment plan.

For sub-standard lives, extra premium may be charged based on KLI's underwriting policy.

For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale.

For details on riders, please read the Rider Brochure.

Insurance is the subject matter of the solicitation.