May 27, 2014

Key man Insurance Policy

Kotak Life Insurance :: Corporate ::

Key person Insurance, also commonly called key man Insurance and key man insurance, is an important form of business Insurance.

There is no legal definition for "key person insurance".

As an Employee Reward / Employee Retention Program:

As an Employer what you can offer to your employees?

Or how can you motivate?

This concept of employer - employee Insurance scheme, is purely as an employee retention tool / reward for the benefit of the employee/s.

Better tax saving methods.

Higher Financial stability

Any number of the employees, either in small group Or preferred employees, or all Or in phases to cover employees, selection of employee, choice is yours.

To put it simply, Key man Insurance is a standard Life Insurance, TPD insurance or trauma insurance policy that is used for business succession or business protection purposes. The policy's term does not extend beyond the period of the key person's usefulness to the business.

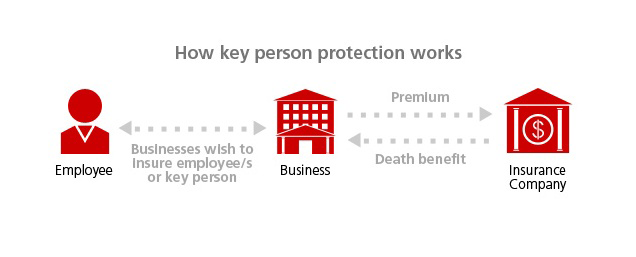

Key man Insurance policies are usually owned by the business and the aim is to compensate the business for losses incurred with the loss of a key income generator and facilitate business continuity.

Key Person Insurance does not indemnify the actual losses incurred but compensates with a fixed monetary sum as specified on the insurance policy.

Many businesses have a key person who is responsible for the majority of profits, or has a unique and hard to replace skill set such as Intellectual Property that is vital to the organization.

The employer does this to offset the costs (such as hiring temporary help or recruiting a successor) and losses (such as a decreased ability to transact business until successors are trained) which the employer is likely to suffer in the event of the loss of a key person.

Who can be a Key man?

Anybody with specialized skills, whose loss can cause a financial strain to the company are eligible for Key man Insurance.For example, they could be:

- Directors of a Company

- Key Sales People

- Key Project Managers

- People with Specific Skills

Key man Insurance Policy ownership

Key man Insurance policies can be owned in a number of ways depending on the needs of the business. It is common for a business to own the policy with claim proceeds being paid directly to the business.

Advantages of key man insurance to the company:

- In case of death of a key man the company gets money to cope up with the loss

- Any company buying key man insurance for its employee can claim a deduction for the premium paid for the policy as a business expense under Section 37(1) of the Income Tax Act.

- No advance intimation/approval is necessary from the Income

- Key man Insurance policy is a positive measure to improve the retention of the key man in the company.

It was a privilege talking to you yesterday discussing on Employer Employee Insurance plans. We had agreed that EE plans are entirely different from KM plans and that the laws pertaining to the latter will not affect the former.

We had discussed that an EE plan upon assignment is taxable in the hands of the employee as perquisite (where employee pays one time tax of 30% on the GSV which would be around 50% of the total premiums paid). And the remaining proceeds or payouts (in the subsequent years as per the policy terms) will be tax free under section 10(10D).

But, after Budget 2013, Section 10(10D) is amended and a new CBDT circular no: 03/2014 dated 24th Jan, 2014 change the definition of Keyman policy. As per new regulation, a Life Insurance Policy taken by a person on the life of another person who is or was the employee of the first-mentioned person or is or was connected in any manner whatsoever with the business of the first-mentioned person.

With a view to plug the loophole and check such practices to avoid payment of taxes, the provisions of clause (10D) of section 10 of the Income-tax Act, 1961 have been amended to provide that a keyman insurance policy which has been assigned to any person during its term, with or without consideration, shall continue to be treated as a keyman insurance policy and consequently would not be eligible for any exemption under section 10(10D) of the Income-tax Act.

Hence, all the acts and circulars make me come to this conclusion: "EE plans are the same as KM plans and all the rules for KM would apply to EE"

The only supporting factor for EE plans is in the IRDA circular which mentions a KM policy to be strictly a Term plan.

All the amendments and circulars after the budget 2013 announcement has changed the entire original meaning of Keyman policy and they seldom refer to maturity proceeds being taxable.

Requesting your suggestion on this.

Thanks.

Vignesh Kumar P

9846106655

Cochin - Kerala

May 29,2015